Fica Tax Rate 2025

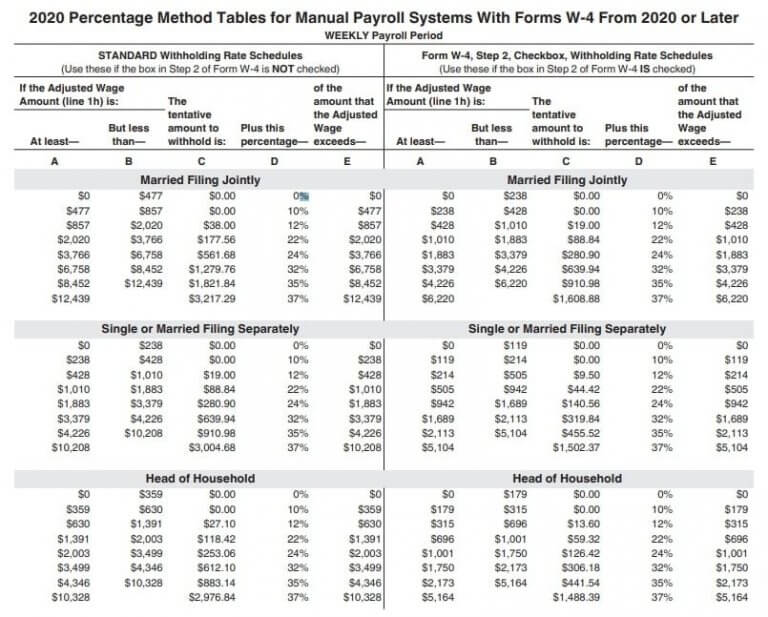

Fica Tax Rate 2025. For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). Social security and medicare tax for 2025.

For the latest information about developments related to pub. How does the fica tax compare to other payroll taxes?

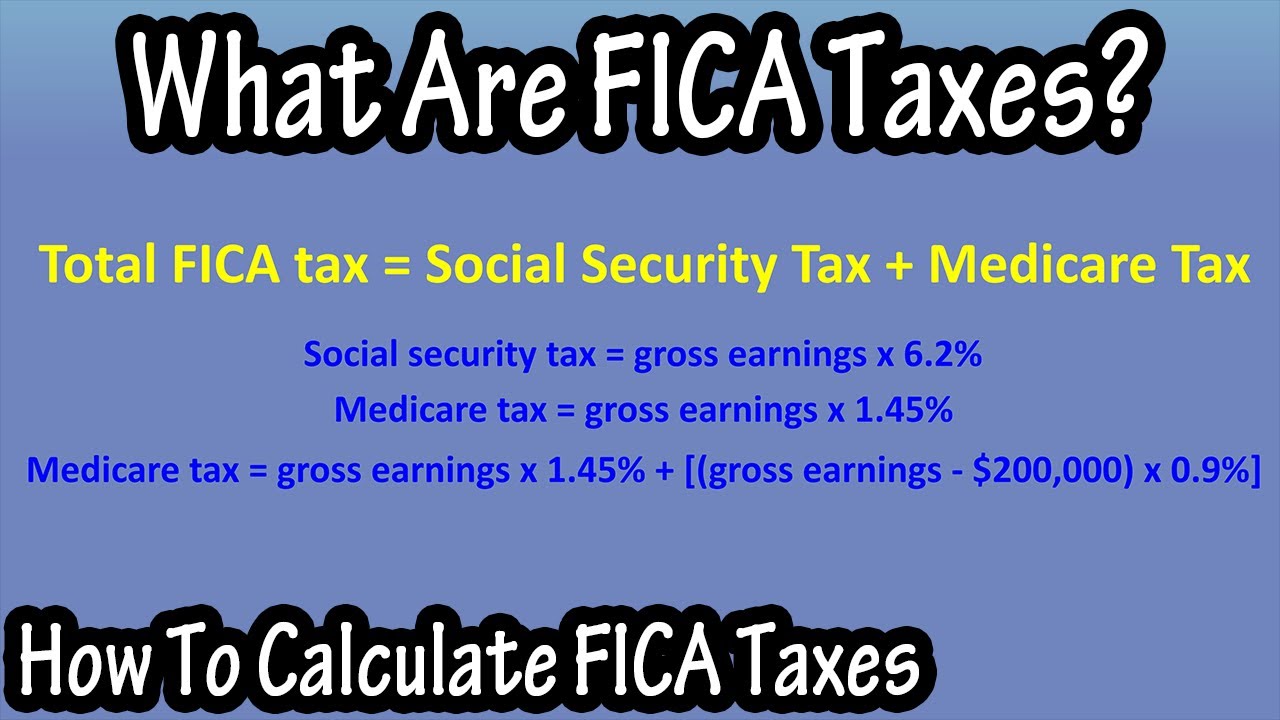

Maximize Your Paycheck Understanding FICA Tax in 2025, That is a total of 7.65% for each party or 15.3% for both parties. In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee and the other half (1.45%) paid by the employer.

What is FICA Tax? The TurboTax Blog, For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively. There is no wage base limit for.

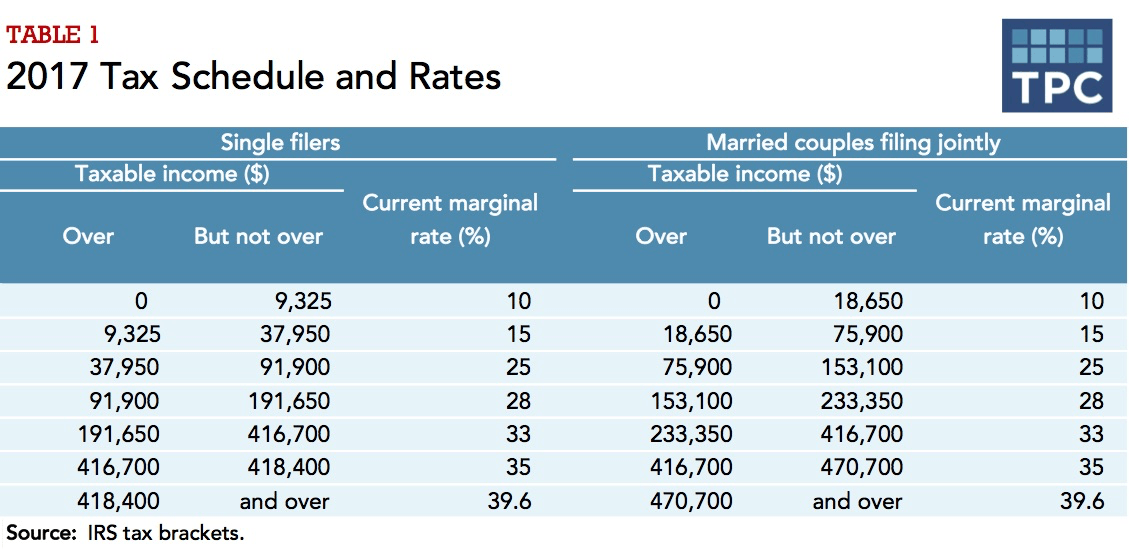

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Here are the changes biden wants to make: The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

2025 Federal Tax Brackets Chart Karyn Marylou, 6.2% goes toward social security tax and 1.45% goes toward medicare tax, which helps fund benefits for children, retirees. What is the history of fica tax rate changes?

FICA Tax Rate 2025, 1.45% for the employee plus. For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Tax rates for the 2025 year of assessment Just One Lap, What are the fica rates and limits for 2025? Office of the chief actuary.

50 Shocking Facts Unveiling Federal Tax Rates in 2025, Your total tax on the. What are the fica taxes?

2025 FICA Tax Limits and Rates (How it Affects You), For the latest information about developments related to pub. Because of this year’s declining inflation rate, the 2025 cola will be much less than the 8.7% increase social security recipients have enjoyed in 2025.

What Is And How To Calculate FICA Taxes Explained, Social Security, For the latest information about developments related to pub. Social security and medicare taxes.

What is FICA Tax? The TurboTax Blog, This article will walk you through everything you need to know to get the most out of your tax return in 2025. The social security wage base has increased from $160,200 to $168,600 for 2025, which.

6.2% goes toward social security tax and 1.45% goes toward medicare tax, which helps fund benefits for children, retirees.